The $100K Mirage: Bitcoin’s Rally Not Backed By On-Chain Strength

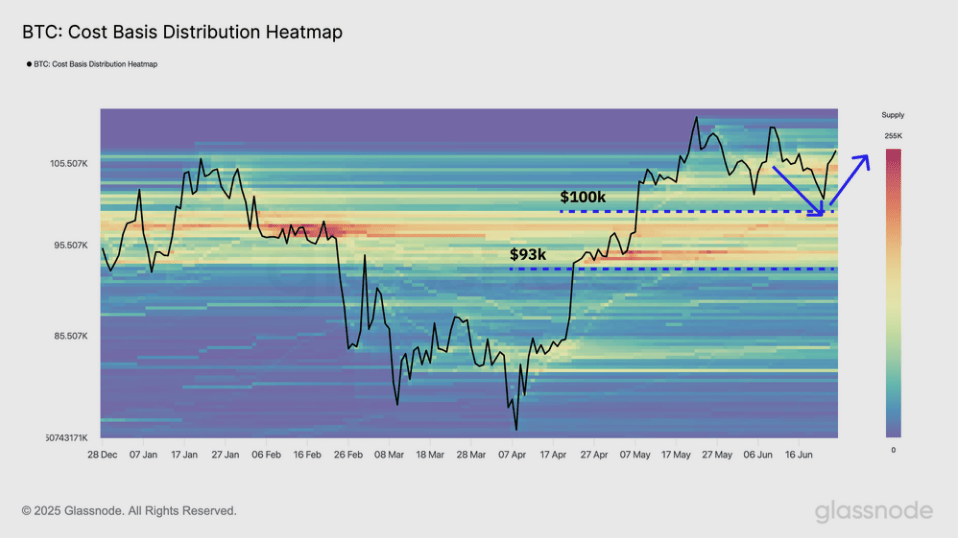

Bitcoin briefly climbed back above $100,000 this month, pushing close to the $108,000 level before a new pullback. The move looks strong on the surface. But based on reports from Glassnode , much of that surge came from traders using borrowed funds, not fresh buyers piling in.

Speculative Bets Fuel Recent Rally

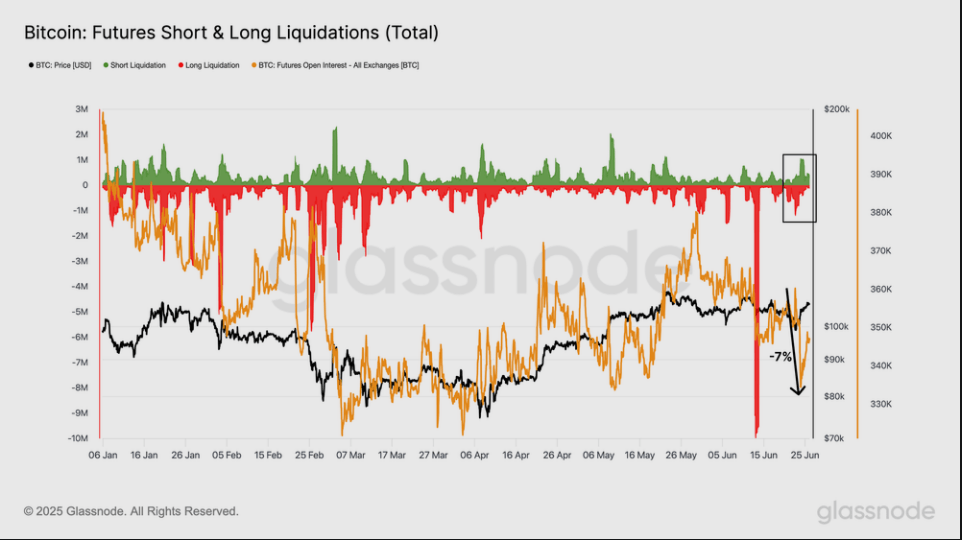

According to on-chain data, late-June’s volume on Bitcoin futures stayed high as prices marched upward. Traders betting on short-term gains drove the market, even as the excitement behind the rally faded. Funding rates and the three-month futures basis both moved lower, signaling less bullish conviction. In other words, fewer people were making big, long bets on Bitcoin these days.

Spot Market Remains Quiet

Spot trading did not follow the futures boom. At its $111,910 peak in May, daily spot volume hovered around $7.65 billion. That’s well below the previous cycle highs, which topped $20 billion on some days. Based on reports, new cash from retail or long-term holders stayed on the sidelines instead of flooding in.

Institutional Buyers Still AddingBig firms did keep buying. This week saw Michael Saylor’s Strategy , Metaplanet and ProCap BTC together pick up about $1 billion worth of Bitcoin. At the same time, US-listed Bitcoin ETFs bought over $1.5 billion in fresh supply. Those steady purchases hint at genuine interest from institutions, even if short-term traders set the pace recently.

Glassnode now shows just 7 million BTC left freely available on exchanges. Roughly 14 million BTC are held by people who haven’t moved their coins in ages. That supply squeeze could support prices if demand holds up. But it also means any sudden sell-off might hit hard when exchange wallets run low.

What Comes Next For Bitcoin

What Comes Next For Bitcoin

All in all, the recent jump above $100,000 feels more like a sprint by margin players than a marathon fueled by new believers. Corrections often follow rallies driven by heavy margin activity. Yet, the ongoing buying by big companies and ETFs offers a buffer. If they keep at it, Bitcoin may need a breather now but could rally again later.

As of June 28, Bitcoin traded at $106,500, down 0.85% on the day. Market watchers will be looking for a return of fresh spot demand or a stabilizing of futures bets before declaring the uptrend back on solid ground.

Featured image from Unsplash, chart from TradingView

Aptos Double Bottom Pattern Points To $10 Bullish Target – Details

In line with the broader crypto market, Aptos (APT) experienced a remarkable price upswing in the pa...

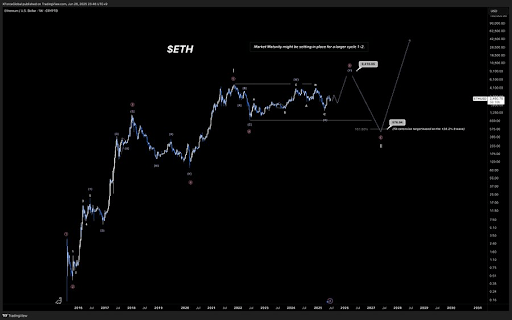

Crypto Analyst Predicts $10,000 ATH For Ethereum This Cycle, Here’s Why

Crypto analyst XForce has predicted that Ethereum could reach a new all-time high (ATH) of $10,000 i...

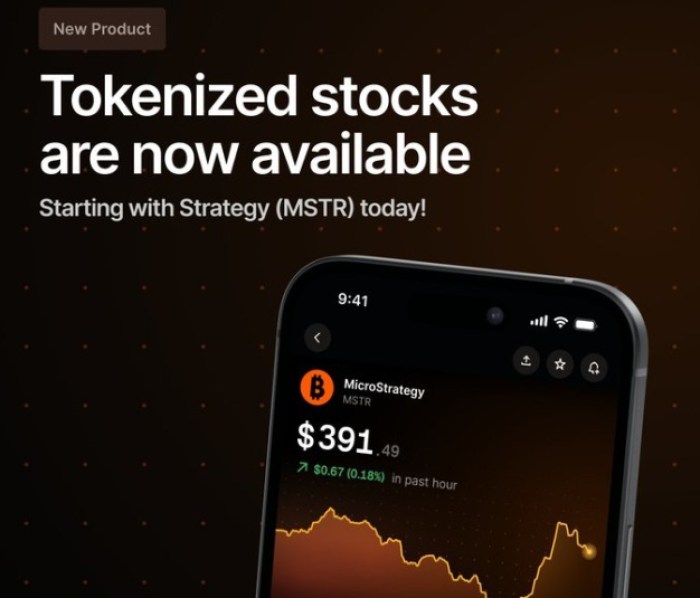

Gemini Just Tokenized a Bitcoin-Heavy Stock – 3 of the Best Altcoins to Ride the Wave

Gemini, a popular crypto exchange, has just launched a tokenized version of Michael Saylor’s Strateg...